hawaii state tax id number

All property lots in Hawaiʻi are defined by a 9-digit TMK number using the following format without any special. That link will take you to a form that requires your ID number last name zip code and the exact amount of your refund.

State of Hawaii Unemployment Insurance.

. All businesses except sole proprietorships with no employees and nonprofits must have a FEIN. Quickly search property records from 54 official databases. HONOLULU AP Hawaii taxpayers will be receiving constitutionally mandated tax rebate over the next several weeks after a rebound in tourism fueled a jump in state tax revenue.

Office hours are 745 am. Forty-four states have a provision in. The Vermont Department of Taxation may.

5 HRS 237D-6 7. Tax Information for 2021. Hawaii State Website.

Are a subsidiary member of a controlled group of corporations be sure to complete. 281 Public Law 116-136 116th Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage. Most personal state programs available in January.

ZEVs sold rented or leased in New Jersey are exempt from the state sales and use tax. Gun laws in the United States regulate the sale possession and use of firearms and ammunitionState laws and the laws of the District of Columbia and of the US. Explore the interactive mapping viewer for projections of future sea level rise.

State e-file not available in NH. Get Tax Help for Your Small Business By Contacting an Attorney. Wheres My State Tax Refund Missouri.

In the United States the Twenty-first Amendment to the United States Constitution grants each state and territory the power to regulate intoxicating liquors within their jurisdiction. 3 State of Hawaii Department of Taxation - Form TA-1TA-2 Line 7. The major difference between Social Security number SSN and any other tax id is that this number is primarily used by individuals for filing taxes while a tax ID number like EIN is used by businesses to file their.

Personal state programs are 3995 each state e-file available for 1995. 6 Hawaii County Transient Accommodations Tax is levied beginning on January 1 2022. NW IR-6526 Washington DC 20224.

Tax Information for 2020. To 430 pm Mondays through Fridays except State holidays. Wheres My State Tax Refund Hawaii.

The registration fee for a GET license is a onetime fee of 20. To avoid inconveniencing taxpayers the Department will continue to process returns and payments received with old Hawaii Tax ID. We welcome your comments about this publication and your suggestions for future editions.

On July 17 1984 the National Minimum Drinking Age Act was. When we compare tax id number vs. You will need to enter your refund amount and either your SSN or your Fed Employer ID.

There are only eight states less densely populated than Nevada. All businesses except. The sales tax exemption does not apply to hybrid electric vehicles.

As such laws pertaining to the production sale distribution and consumption of alcoholic drinks vary significantly across the country. Get an Identity Protection PIN IP PIN. Social Security Number the most important aspect that stands out is that SSN is a type of TIN.

Individual income tax return W-2 form or income tax form 1099 from the previous year Hawaii individual income tax return or HW-2 form filed in the last two-years Letter from the Hawaii State Department of Human Services indicating the person is receiving welfare assistance dated not more than 90-days old. Hawaii Tax ID number prefixes also make it possible to know the associated tax type at a glance. Apply for an Employer ID Number EIN Check Your Amended Return Status.

Territories vary considerably and are independent of existing federal firearms laws although they are sometimes broader or more limited in scope than the federal laws. Apply for an Employer ID Number EIN Check Your Amended Return Status. The landlocked state of Nevada covers 109826 square miles of land area making it the seventh-largest state in the country.

Is there a fee to request a duplicate license. The State of Hawaii is addressing climate change mitigation and adaptation. State outside North America the only state that is an archipelago and the only state geographically located within the tropics.

Reference sheet with Hawaii tax schedule and credits. Alaska Wyoming Montana North and South Dakota New Mexico Idaho and Nebraska. Instructions for Form 1040.

ZEV Sales Tax Exemption. Hitaxhawaiigov you will receive your HI Tax ID in approximately 5-7 days. Unless you operate a sole proprietorship or an LLC with no employees you will most likely need a tax ID number for your small business.

The new Hawaii Tax ID number format makes it easy to distinguish between customer ID and Hawaii Tax ID account numbers. Booklet A Employers Tax Guide Rev. State e-file available for 1995.

The best way to learn about tax ID numbers and other aspects of business tax law is to speak with a skilled tax attorney near you. Sole proprietorships with no employees and nonprofits must have a FEIN. This state is very sparsely filled.

116th Congress Public Law 136 From the US. Government Publishing Office Page 134 STAT. Hawaiʻi həˈvɐjʔi or həˈwɐjʔi is a state in the Western United States located in the Pacific Ocean about 2000 miles from the US.

Read More Entries from News. Looking for FREE property records deeds tax assessments in Hawaii. We would like to show you a description here but the site wont allow us.

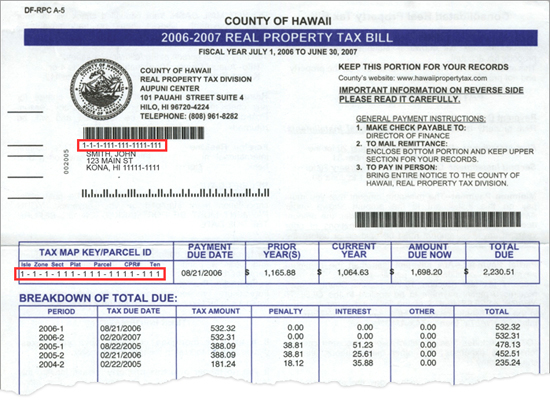

Tax Map Key TMK parcel boundaries for the State of Hawaiʻi. A deferred compensation plan for employees. Telephone number is 808 586-1024.

Limited Circumstances When Multistate PUA Claims Are Permitted. E-file fees do not apply to NY state returns. Enter your Federal Employer Identification Number FEIN Tax Identi-fication Number TIN or Social Security Number SSN.

It is the only US. Enter your Federal Employer Identification Number FEIN Tax Identi-fication Number TIN or Social Security Number SSN. A summary of state taxes including information on tax rates forms that must be filed and when taxes must be paid.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. The New Jersey Department of Environmental Protection provides grants through the It Pay to Plug In program. 4 Hawaii Revised Statutes HRS 237D-2.

Outline of the Hawaii Tax System as of July 1 2022 4 pages 405 KB 712022. Lines 17 18 19 and 20. State e-file not available in NH.

Release dates vary by state. 2021 58 pages 452 KB 9132021. Get an Identity Protection PIN IP PIN Pay.

2 State of Hawaii Department of Taxation - Form TA-1TA-2 Line 3 Column C. If you are a subsidiary member of a controlled group of corporations be sure to complete lines 17 18 19 and 20. Individual Tax Return Form 1040 Instructions.

Hawaii h ə ˈ w aɪ i hə-WY-ee. Search this site Search. You may be able to exclude from gross income certain rebates or reductions of state or local property or income taxes and up to 50 per month provided by a state or local government.

Hawaii comprises nearly the entire.

Hawaii Boat And Trailer Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template In Microso Template Printable Templates Free Printables

W2 Tax Document Business Template Tax Bill Template

Id 6503 Shiny Purple Hibiscus Flower Patch Hawaiian Embroidered Iron On Applique

South African Birth Certificate Template Unique 019 Official Birth Certificate Template Sen Birth Certificate Template Birth Certificate Fake Birth Certificate

Id 0227 Tropical Hawaii Fish Patch Sport Fishing Embroidered Iron On Applique

Fresh Certificate Of Compliance Template Certificate Templates Free Certificate Templates Certificate Of Completion Template

Tax Clearance Certificates Department Of Taxation

Pin By Sandy Cox On Brenda Amay Galax Development

Licensing Information Department Of Taxation

Mbti As Quotes By Their Types Mbti Infj Personality Type Intj Personality

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money